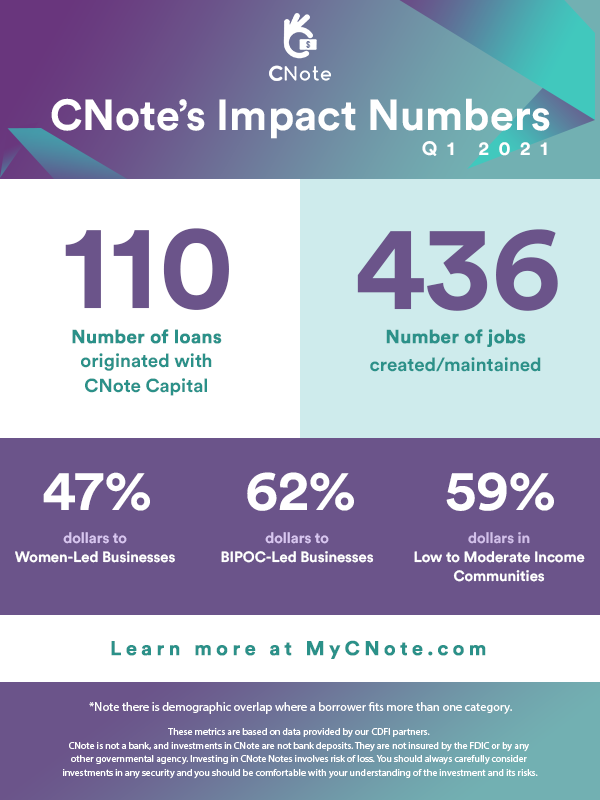

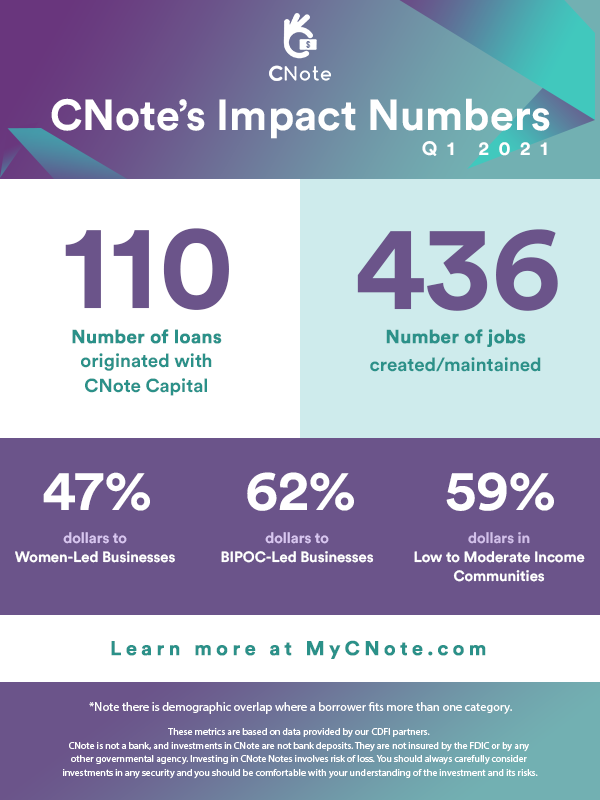

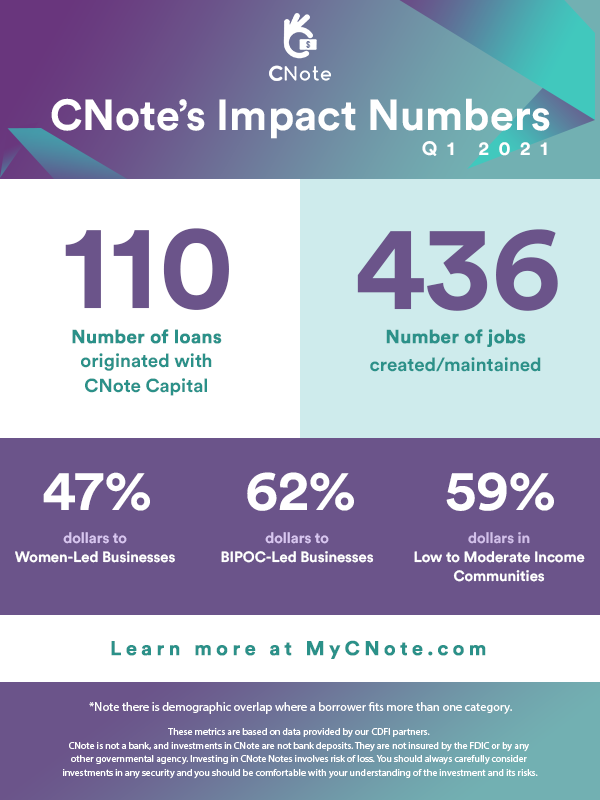

We’re proud to share CNote’s Q1 2021 impact data.

In Q1 2021, our members helped create/maintain over 400 jobs, and over 60% of all CNote investments funded BIPOC-Led Businesses.

To view our full Q1 Impact Report, click here

In Q1 2021, our members helped create/maintain over 400 jobs, and over 60% of all CNote investments funded BIPOC-Led Businesses.

To view our full Q1 Impact Report, click here

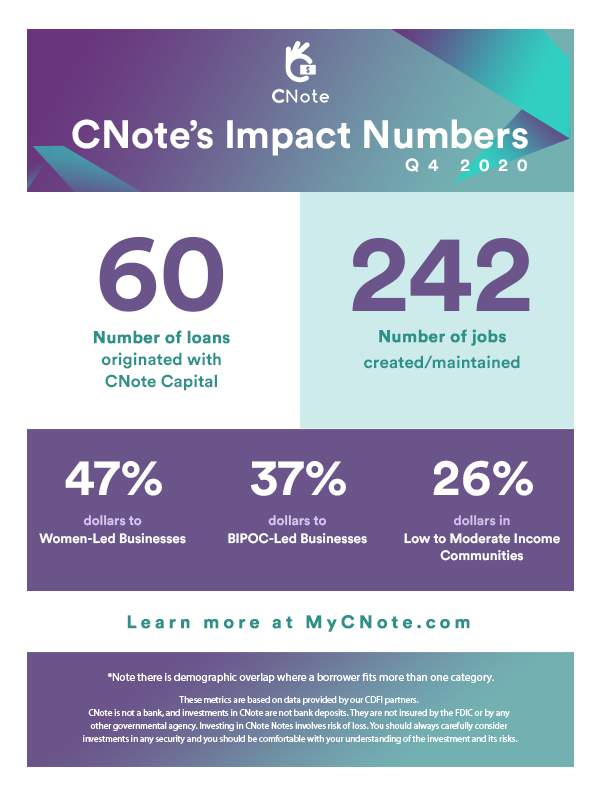

We know one of the main reasons you invest with CNote, is because of the impact your investment has.

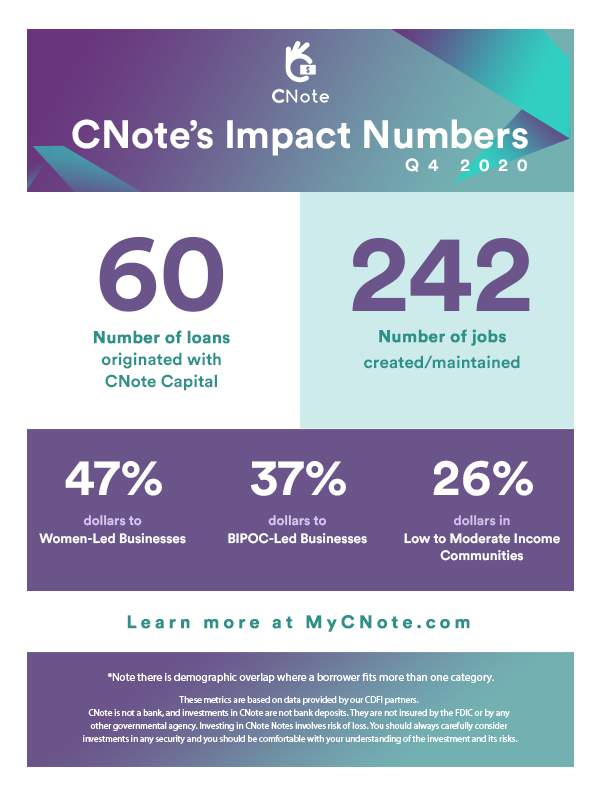

In Q4 2020, our members helped create/maintain over 240 jobs and over 45% of all CNote investments funded women!

In Q4 2020, our members helped create/maintain over 240 jobs and over 45% of all CNote investments funded women!

If you’d like to see our annual impact data, along with an explanation of how we map CNote’s impact investments to the UN’s Sustainable Development Goals.

We know one of the main reasons you invest with CNote, is because of the impact your investment has.

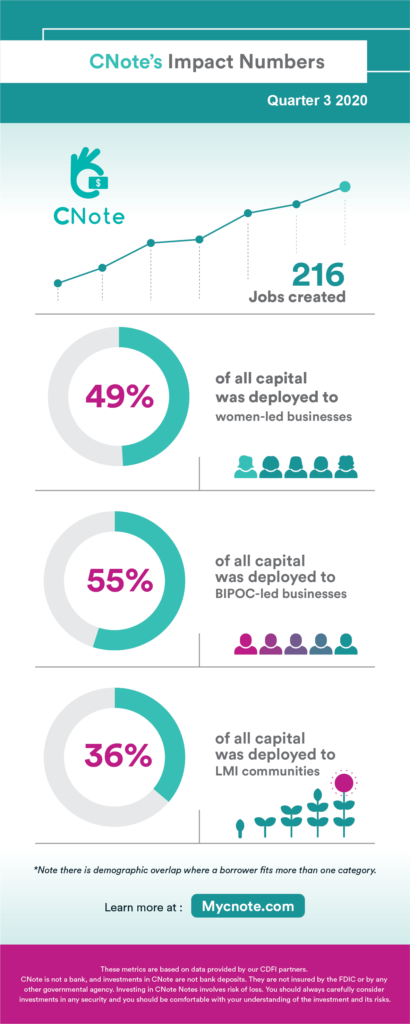

In Q3 2020, our members helped create/maintain over 200 jobs!

If you’d like to see our annual impact data, along with an explanation of how we map CNote’s impact investments to the UN’s Sustainable Development Goals.

We know one of the main reasons you invest with CNote, is because of the impact your investment has.

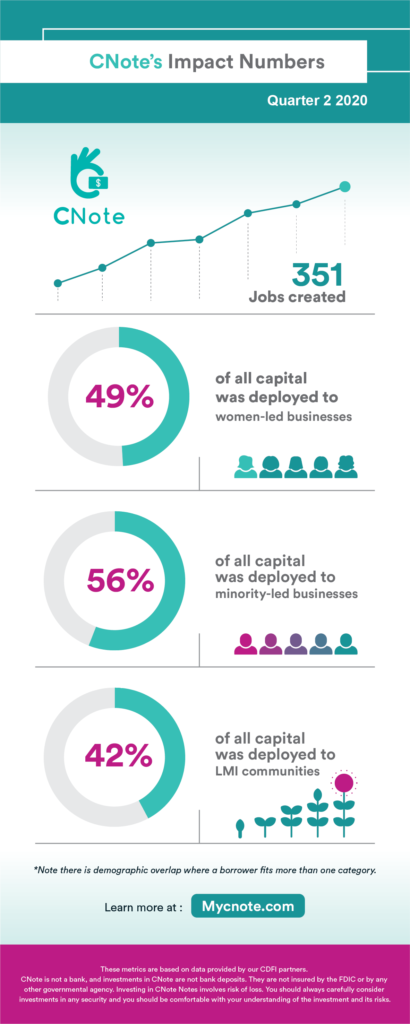

In Q2 2020, our members helped create/maintain 350 jobs!

Over half of all invested capital was deployed with minority-led businesses and we deployed nearly half of all dollars to female borrowers!

If you’d like to see our annual impact data, along with an explanation of how we map CNote’s impact investments to the UN’s Sustainable Development Goals.

Our 2019 Annual Impact Report is also available if you’d like to learn more about the impact CNote is having on communities and individuals across America.

We know one of the main reasons you invest with CNote, is because of the impact your investment has.

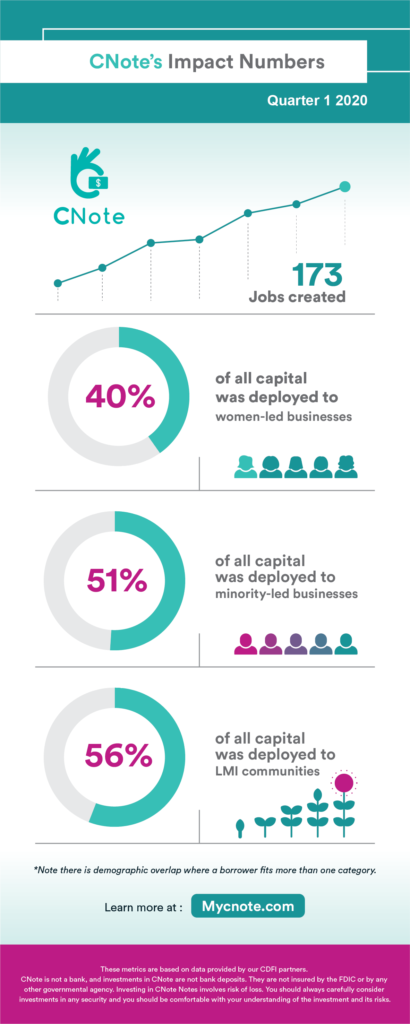

In Q1 2020, our members helped create/maintain 173 jobs!

Over half of all invested capital was deployed with minority-led businesses.

If you’d like to see our annual impact data, along with an explanation of how we map CNote’s impact investments to the UN’s Sustainable Development Goals.

Our 2019 Annual Impact Report will be published soon, we apologize for the delay which was caused by the ongoing pandemic.

We know one of the main reasons you invest with CNote, is because of the impact your investment has.

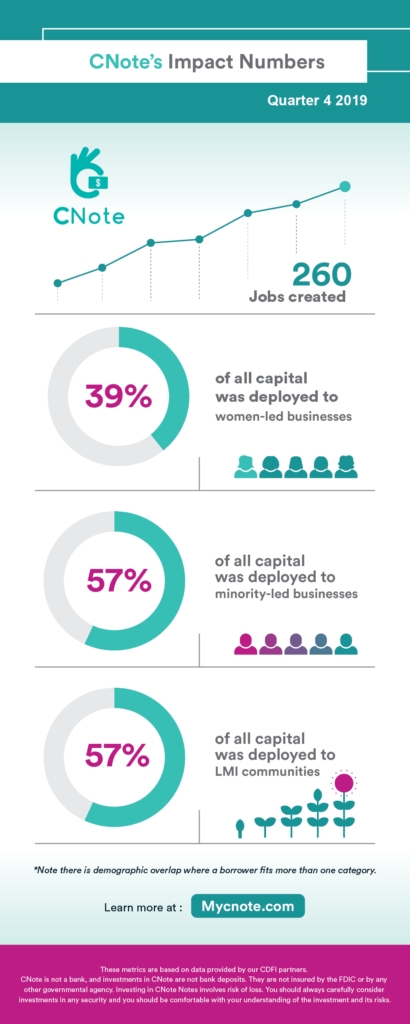

In Q4 2019, our members helped create/maintain 260 jobs!

Over half of all invested capital was deployed with minority-led businesses.

If you’d like to see our annual impact data, along with an explanation of how we map CNote’s impact investments to the UN’s Sustainable Development Goals, read our 2018 Impact Report.

Our 2019 Annual Impact Report will be available soon.

We know one of the main reasons you invest with CNote, is because of the impact your investment has.

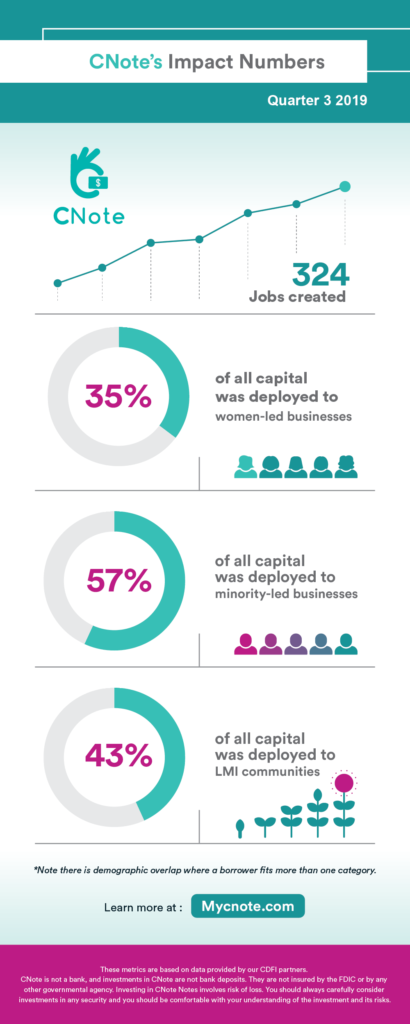

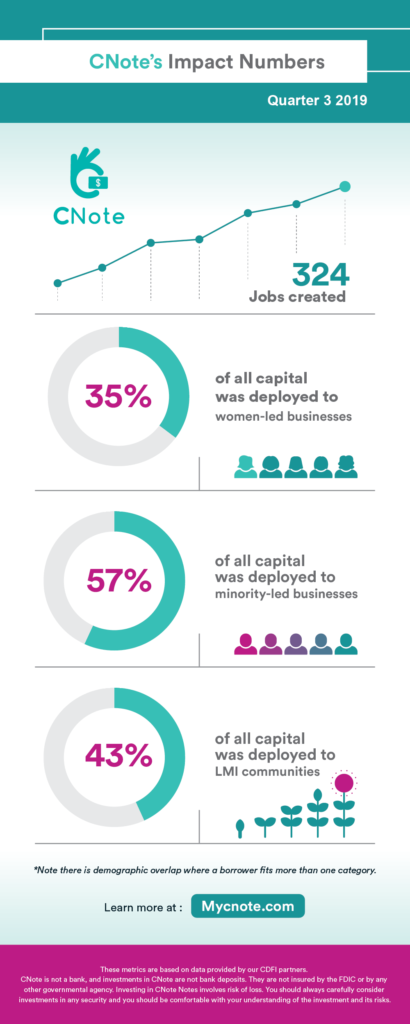

In Q3 2019, our members helped create/maintain 324 jobs!

Over half of all invested capital was deployed with minority-led businesses.

If you’d like to see our annual impact data, along with an explanation of how we map CNote’s impact investments to the UN’s Sustainable Development Goals, read our 2018 Impact Report.

We know one of the main reasons you invest with CNote, is because of the impact your investment has.

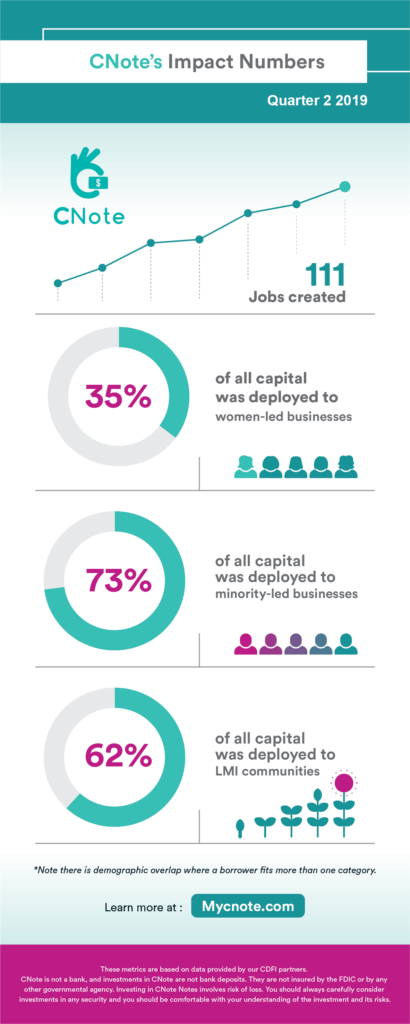

In Q2 2019, our members helped create/maintain 111 jobs!

We’re also extremely proud to announce that more than 70% of CNote capital went to minority-owned businesses!

If you’d like to see our annual impact data, along with an explanation of how we map CNote’s impact investments to the UN’s Sustainable Development Goals, read our 2018 Impact Report.

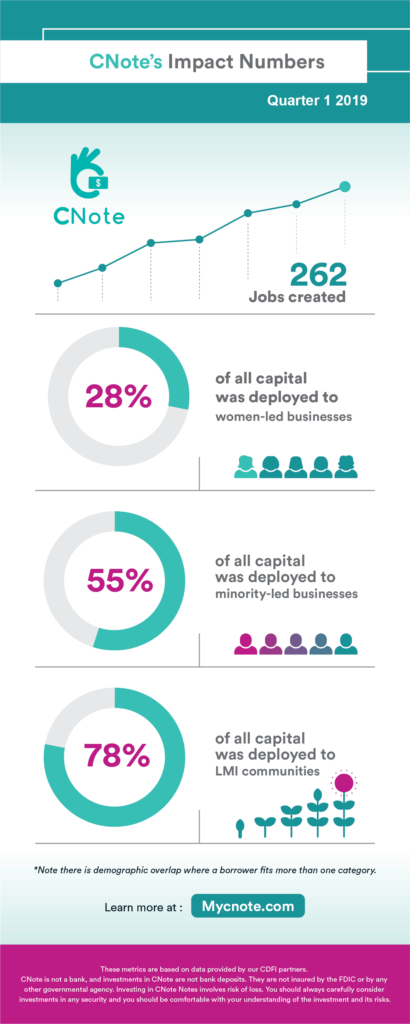

We know one of the main reasons you invest with CNote, is because of the impact your investment has.

In Q1 2019, our members helped create/maintain 262 jobs!

Over half of all invested capital was deployed with minority-led businesses. We’re also extremely proud to announce that more than 78% of CNote capital went to LMI communities!

If you’d like to see our annual impact data, along with an explanation of how we map CNote’s impact investments to the UN’s Sustainable Development Goals, read our 2018 Impact Report.

Seeing the impact of your investment is a persistent challenge for impact investors.

It can be difficult to take abstract metrics like dollars invested or jobs created and visualize what that means for individuals and the communities they live in.

We created this short video to highlight how impactful your investment in CNote can be.

If you would like to read the detailed profiles of these success stories, you can review them here.

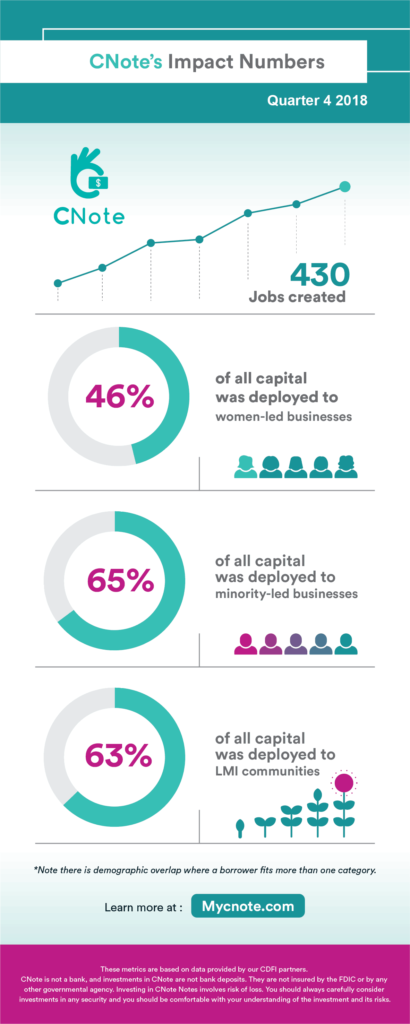

We know one of the main reasons you invest with CNote, is because of the impact your investment has.

As you may have noticed, our quarterly job creation numbers are trending upwards along with our allocations across key demographics, like women, minority communities, and LMI communities.

In Q4 2018, our members helped create/maintain 430 jobs!

Over 65% of all invested capital was deployed with minority-led businesses!

We are extremely proud of our Q4 results and will be releasing our full 2018 Impact Report shortly. In the interim, check out our 2017 Annual report.

That idea is embedded in our social mission of closing the wealth gap and building a more inclusive economy for everyone.

Our team thought it was only natural we formalize that commitment by becoming a Certified B Corporation®. Now CNote’s commitment to profit with purpose becomes even more clear for our investors, members, and partners.

We’re excited to join a growing list of companies that are working to build sustainable businesses along with a better world.

Some statistics about B Corps™:

CNote was certified by the non-profit B Lab to meet rigorous standards of social and environmental performance, accountability, and transparency. That required us to evaluate how our practices impact our employees, our community, the environment, and our customers.

“Think of it this way: USDA certifies organic foods, and Good Housekeeping puts its seal of approval on quality products, like washing machines and skillets. And since 2006, a nonprofit organization called B Lab has been certifying corporations it deems to be concerned about their communities and the environment.” – NPR

Certified B Corporations® are a new kind of business that balances purpose and profit.

They are legally required to consider the impact of their decisions on their workers, customers, suppliers, community, and the environment.

This is a community of leaders, driving a global movement of people using business as a force for good.

The entire CNote teams is excited to be a part of this movement!

Our mission at CNote is to create competitive financial products that make money for our investors while building a more inclusive economy.

Seriously.

We know its a big goal, but big goals can create big change.

Occasionally, we’re lucky enough to receive industry recognition or build partnerships that help push us towards our goals and remind us that the work we’re doing resonates with a broader audience.

This week is one of those weeks for our team.

We wanted to briefly mention a few highlights we’re proud of.

We’re excited to announce that we’ve been selected to join this year’s Mastercard Start Path cohort.

It’s a long-running program with a track record of helping startups build key partnerships and gain broader access to customers, investors, and ecosystems.

It’s a long-running program with a track record of helping startups build key partnerships and gain broader access to customers, investors, and ecosystems.

Nearly 200 companies have participated in the program, and we’ve connected with nearly 10,000 of the world’s smartest startup founders to build the future of commerce together.

Thanks to the entire Mastercard team for their support!

Additionally, we’re grateful for recent recognition from CB Insights in their 2019 Fintech Trends to watch report.

We were previously invited to their Demo Day event, and given CB Insights’ growing reputation as a key provider of business intelligence and predictor of trends, we’re grateful they think our impact-focused Fintech company is worth a mention.

If you’re interested in Fintech or just enjoy lots of charts, their 2019 report is worth a look. The slide (p. 77) mentioning CNote is excerpted below.

Yahaira and her sister Onaney

It’s October 1st, 2013, opening day for Nail Glam Studio and Yahaira Caraballo is nervous. After months of grueling effort, her south Bronx-based nail salon is finally ready and open to the public.

The only problem? The public didn’t come. Not on the first day, at least.

Like everything that brought her to this point, however, Yahaira’s persistence soon paid off. Although Nail Glam Studio, in her own words “didn’t make a dime the first day,” it did manage to turn a profit by the end of the first week and has only grown since.

Nail Glam Studio Founder, Yahaira Caraballo

While Yahaira’s determination enabled her to push past a number of obstacles, it took the help of many other hands to effectively turn Nail Glam Studios from a vision in her head into a thriving business.

One primary source assistance came from CNote’s CDFI partner, the Pursuit Lending, which provided essential guidance in the early stages of forming the business, along with the funds to make the necessary upgrades to comply with new regulations and to expand operations.

The other essential ingredient in Yahaira’s small business success story is family. From her brother helping to build and repair the shop to her husband providing the painting expertise, she was not short on support from those closest to her.

Yahaira did not just receive help from family, however, but was able to provide something even more important to her sister, Onaney Caraballo. In fact, one could say that Onaney was the driving force behind the idea to open Nail Glam Studios all along.

Yahaira was sure that she wanted to start a business since she was young but just couldn’t find a place where she could make an impact. Despite taking on a full-time job in New York City, she still never lost her entrepreneurial ambition and continued to look for ideas and ways that she could turn her dream into reality. In the end, her sister provided the inspiration to finally take the steps towards forming a small business of her own.

Nail Glam Studio Team

Following a move to New York City from their native Dominican Republic in 2003, Onaney quickly established herself as a stylist, gaining recognition at local nail salons and practicing on Yahaira in her spare time. Seeing her sister’s talent and looking to finally realize her own dream to be a small business owner, Yahaira cleared her savings account and began to take the steps necessary to open Nail Glam Studios.

Nail Glam Studios soon become more than just a business for the two sisters. In fact, it became a way for both to live out their respective dreams and come together in a way they never previously imagined. Where Yahaira could fulfill her ambition of owning and operating a small business, Onaney could finally have the kind of stable and supportive working environment that enabled her to focus on improving her craft without worrying about working hours or other issues that usually come with freelance and studio work.

The idea was in place. Now Yahaira just needed funding to get Nail Glam Studios off the ground.

Yahaira first sought to get a personal loan from Chase Bank. Such loans come attached with high interest rates on repayment, but Yahaira was dedicated to seeing the idea of opening a nail salon for her sister through to completion. While she was refused for the loan on the grounds because that local branch did not invest in small businesses of Nail Glam’s size, she was given referrals that culminated with her collaboration with Pursuit.

Pursuit helped connect Yahaira with the right experts, who were able to walk her through the intricacies of operating a small business. For example, they taught her how to complete the required paperwork, including a fully-formed business plan, that were required to apply for a loan. Along with the business advice and guidance, Pursuit provided the loan necessary for Nail Glam Studio to comply with the aforementioned state regulations, as well as enable the hiring of two additional staff members to expand the business with new pedicure and manicure stations.

Success and Community-Centered Growth

Success and Community-Centered GrowthSince that first day without a paying customer, Yahaira estimates that they see more than one new customer every day simply through word-of-mouth. She credits this to a number of factors, including her focus on providing quality service at an affordable price. However, the emphasis on building a strong community is what really sets Nail Glam Studios apart from other nail salons in the area.

To that end, Nail Glam Studios holds community events every three months, usually corresponding with public holidays like Mother’s Day and Thanksgiving. Yahaira sees the events as a way to give back to those who are a vital component in the nail salon’s success.

Yahaira particularly enjoys Customer Appreciation Month, held every October to commemorate Nail Glam Studio’s founding–and that first nerve-wracking day–where she provides free goodie bags filled with nail-care products to customers.

Yahaira with her brother and sister

While building a community of happy customers in the south Bronx makes Yahaira proud, the most meaningful impact comes from much closer to home. A great example coming in the form of a text message from her nephew. In that message, he thanked his aunt for providing a place for his mom, Onaney, to practice nail styling and pursue her passion. This display of gratitude touched Yahaira and served as proof that she had achieved in what she set out to do–both professionally and personally. After all, none of this would have happened without Onaney, and now the sisters have succeeded in building a thriving business together.

What began as a three-person operation has, with the help of the SBA micro-loan from Pursuit, now expanded to a staff of seven. For her part, Yahaira says that she is grateful for the loan and all support she has received until now from Pursuit. “I’m speechless with everything I’ve gotten as result of submitting this application. They have a lot to offer.”

Yahaira is now paying forward the help she was given by Pursuit in her own way, assisting other small business owners in the south Bronx as they seek to overcome the inevitable struggles encountered while striving to their own entrepreneurial dreams. She also has ambitions to open another store in the future to create even more employment in the local community.

Her story underscores the commitment of CNote and the Pursuit to helping ambitious women like Yahaira receive the support they need to turn their dreams into reality and enable local communities to thrive as a result. If you, too, would like to make a difference, please consider investing in CNote today.

There’s a saying that goes, “If you bought it, a truck brought it.” That may only be true 73.7% of the time, but either way, there are a lot of truckers out there in the U.S. delivering the things that we use and rely on every day. Over a million, in fact.

Marley Transport & Trucking is one of those trucking companies. Yet, when we interviewed founder Shavon Marley, we found the incredible story behind this company is what makes it stand out from the crowd.

Shavon Marley, Owner & Founder of Marley Trucking

True to its name, Marley is largely a family-operated business. Shavon Marley started the company. Later, her husband took the primary role as head of operations and dispatch. Her dad was the first driver they hired, bringing decades of experience and industry connections to the table. Her uncle, who had gotten involved in trucking through her dad, is their second driver; and their third and most recent, added due to a higher volume of work, is a friend of a friend.

Marley may be one trucking company out of millions, but it’s more than a business, it’s a family, both literally and figuratively. Needless to say, this small company, which continues to grow, is not only having a significant impact on Shavon’s family but her community as well.

Marley Trucking Team

For Shavon and her husband, it was a dream long in the making. Originally Shavon worked full time in sales, and her husband in cable and satellite installation, a demanding job that required him to work six days a week outdoors. “My husband and I were high school sweethearts also,” she told us. “…We always had this thing where one day we would figure out how to have our own business and set our own schedules, and be able to travel and be able to work from wherever we travel.”

That was the dream. But it was not until the onset of some difficult and unexpected circumstances that Shavon began to take action, turning her dream into a reality.

Hyperbaric oxygen therapy room (Photo credit: mayoclinic.org)

The above image is of a therapy session occurring in a hyperbaric oxygen chamber. In 2016 Shavon would find herself spending a lot of time in these tanks: she was diagnosed with breast cancer in April of that year.

Others may have balked in the face of such hardships, but Shavon made the most of it. Her treatment allowed her “a lot of time away from work, and also a lot of time to think,” she told us with a laugh. Therapy sessions would last 7 hours each and occur 2-3 times a week — all without the distraction of electronics. She used the time to ruminate at length about the business she and her husband had always wanted to start.

“I’m picking up on inspiration everywhere.” -Shavon Marley

But she didn’t only think. She found herself engaging in conversation with some other patients. “I’m in this tank with all old people — but a really good group of old people.” This included business owners, people experienced in the trucking industry, and even a woman who had started a welding business and could provide advice in thriving in a male-dominated industry. “I’m picking up on inspiration everywhere,” Shavon told us. “So I’m going into this tank with my pen and paper, and I’m getting my questions answered.”

For some specific concerns, however, the people she was close to didn’t have all the resources she needed. “I didn’t really have immediate people within my trust circle I could go to and say, ‘How do I do this? What do I need to know? Does the loan make sense?’…I just didn’t know what to do.” Meanwhile, there was an increasing source of pressure in her ever-growing absence away from work, and her husband’s own job whose hours were long and kept them apart at such a challenging time.

Marley Trucking, a story of teamwork

But her father, a seasoned trucker, always believed in her. “He’d always tell me, ‘You’re a big girl, you’re smart, you can figure it out, you can figure anything out…’ — Okay, well, if I figure it out,” Shavon recounted, “then I solve all these problems.” With some help, she did.

One big part of the equation was assistance from Carolina Small Business.

When Shavon first connected with Scott Wolford of Carolina Small Business Development Fund, the business she had in mind was a dump truck business. Eventually, this would evolve into the transport and trucking business of today. Needless to say, there was extensive thinking, collaboration, and planning along the way, but Scott’s guidance helped see her through.

Scott found a driven, hardworking client in Shavon. “I think he could tell I’d never written a business plan before,” Shavon recounted. “But I think he picked up on the fact that I’ll research any and everything until I figure it out.” He directed her energies by coaching her on writing the business plan, providing tools and resources, and bringing certain costs and considerations to her attention — “all the things that you really have to kind of put some time into forecasting when you’re starting a business.”

In April of 2018, all of the hard work came to fruition. Shavon received a loan which was able to support her new business and fund insurance for the trucks in her growing enterprise. On April 30, 2018, Marley Transport & Trucking pulled its first load. Since then Marley Trucking has continued to grow and establish itself as a reliable transportation option across North Carolina.

The fast-growing fleet

There were still challenges after launch, such as finding brokers, meeting a high volume of work, and navigating the logistics of intermodal hauling. But Shavon used her trademark grit and research abilities to pull through. Now Marley Trucking has three drivers and does intermodal hauling from the Port of Wilmington.

Recently, Shavon and her husband took a trip to Mexico. Her husband would check his laptop in the mornings, but the afternoons would be devoted to hitting the beach. Working from wherever and whenever they want — their dream had finally come true.

“I don’t think we could’ve done any of that…without the funding,” Shavon told us. “We certainly wouldn’t have been able to grow.”

Marley Trucking is based out of Raleigh, NC. If have transport needs in North Carolina, they can be reached at 919-757-5425.

Carolina Small Business fosters economic development in underserved communities through access to capital, business services, and policy research. Since 2010, the non-profit community development financial institution has invested more than $50.7 million through 661 loans to small businesses across North Carolina helping to create or retain more than 2,267 jobs.

CNote has always been committed to delivering tangible social impact while providing competitive financial returns. In 2019, we’re increasing the return on all CNote accounts to 2.75% as we work to prove that investing in a better world can still be profitable.

We’ll continue to deliver the same great impact along with assuring that the capital we provide our non-profit partners is affordably priced and will continue to support sustained economic development in communities across America. CNote’s ultimate mission is to help close the wealth gap in America by increasing access to capital for communities that were commonly cut off from traditional funding sources.

Maria Harrington, Owner of Casa de Español, a CNote small business success story

As CNote’s CEO Catherine Berman noted, “For a long time, doing something good with your money wasn’t always the smartest financial decision. We’re challenging that thinking. In 2019, we’re making it even more financially rewarding for our members to invest with their values. If you’ve got extra cash sitting in an account paying you next to nothing, an investment in CNote is a great way to make your money work for you in 2019.”

Existing members don’t have to do anything and will see the increased earnings reflected in their account dashboard for January.

New members can sign up today and enjoy the increased rates starting January as well.

Additionally, CNote members can increase the APY on their accounts up to 3.00% by referring friends and family. You can learn more about the bonus requirements when you log into your secure dashboard.

You can review the full press release here.

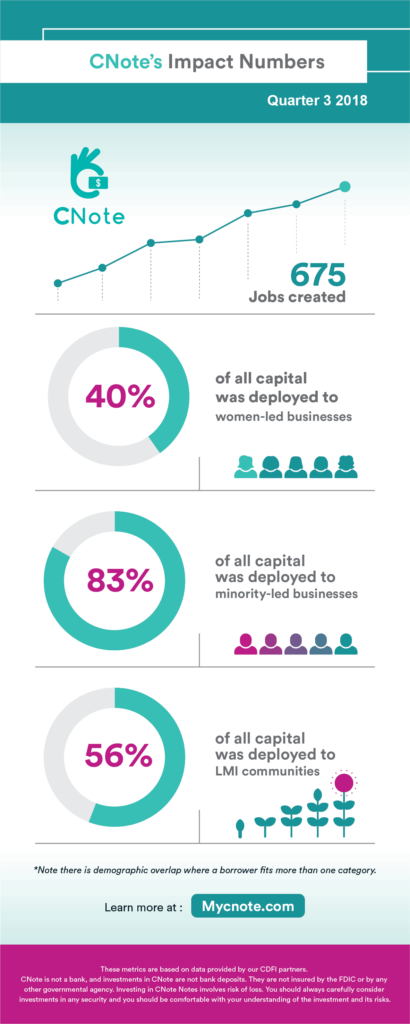

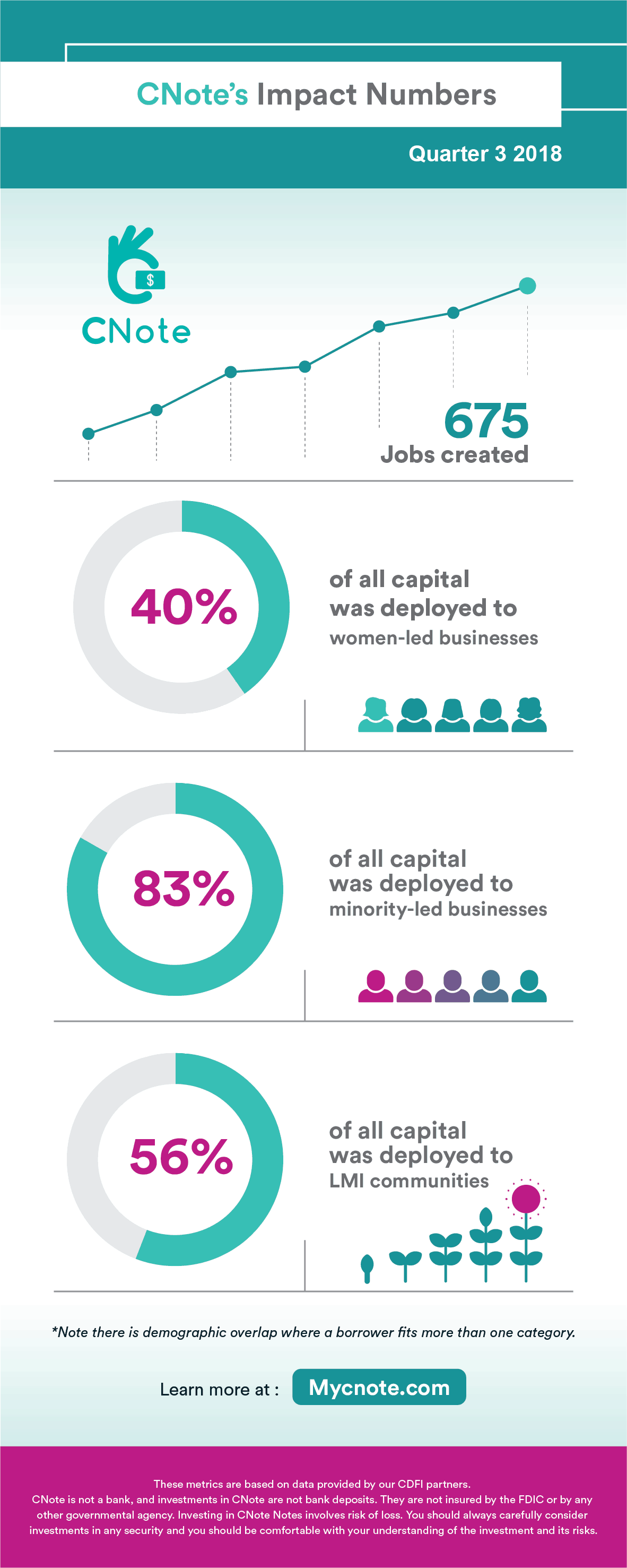

We know one of the main reasons you invest with CNote, is because of the impact your investment has.

Our network of CDFI partners continues to grow along with our capital allocation thanks to investments from members like you.

Members like you helped create/maintain 675 jobs!

You’ll be happy to know that your money went directly to underserved communities with over 83% of all invested capital going to minority-led businesses!

We are extremely proud of our Q3 results and look forward to delivering even more impact in Q4 and beyond.

The Camp Fire is the deadliest and most destructive wildfire in California’s history. The fires have charred an area the size of Chicago, razing over 14,000 residences, taking 85 victims, with hundreds more still missing. (source)

Given that CNote is an Oakland-based company, we wanted to support our neighbors to the north, that have been through so much, for #GivingTuesday Read More

Often, we profile small businesses that may be solo operations or just have a handful of employees–yet the entrepreneurs that run those companies will always have a grand vision for just how big they can grow their companies. For many their benchmark may be focused on the number of customers they serve or the number of employees they have–but you can always be sure that the vision is ambitious. Read More

The markets have been quite volatile over the last few weeks. Navigating wild price swings and the emotions that come with them can be a challenge, we wanted to share this brief note from the CNote CEO on what this volatility means for your investment in CNote. Read More

When most of us think of learning a language, we often think of textbooks and flashcards, not rich cultural experiences.

Some may even think of tape recorders, AP tests, and the crutch of Google Translate — but Casa de Español has something else to say about that.

Catherine Berman, CNote CEO stopped by the “basement” to have a chat with Joe, the beloved host of the wildly popular Stacking Benjamins podcast.

If you’re looking to learn more about CNote and how it works, then this interview is worth a listen. We highly recommend you check out the entire episode, but if you just want to get to the CNote part, skip to 23:30. Read More

Benzinga hosted its annual Fintech Awards yesterday, May 15th, in New York. Read More

This year, National Small Business Week runs from April 29th to May 5th. Read More

CNote commissioned a survey to understand how people plan to use their tax returns this year. We also asked those same people whether they thought the recent tax law changes would benefit them. Read More

We don’t think of schools as small businesses in the traditional sense. But consider the private school. Like any small business, it is often forged from one person’s vision, supported by the time and intention of dedicated educators, and sustained by capital from both investors and students. Read More

We’re proud to announce that CNote has been selected as a finalist for The Luis Villalobos Award. This is a highly regarded, North American-wide award that honors ingenuity, creativity, and innovation among startups backed by Angel Capital Association (ACA) members. Read More

The first line of defense in information security is… you! Read More

Today, when we think of patients, we think of people wearing hospital gowns with IV tubes strapped to their wrists. But in the original Latin usage, the word “patient” had a much simpler meaning. A patient was “one who is suffering”—someone who is defined by their sufferings, unable to do anything about them. Read More

Today, CNote is profiling Incausa, and its co-owners, Vinicius and Carolina. Together, they’ve built a company that sells unique goods across the globe but also supports indigenous artisans by selling their crafts and returning 100% of the proceeds to them. Incausa received a loan from a CNote partner that allowed them to scale their company without sacrificing their social mission.

Demo Day was a great opportunity to share the CNote story with a diverse group of industry thought leaders.

More than anything, CNote is excited to be recognized as one of “40 of the most ground-breaking early-stage startups” out of a pool of more than 2,000 applicants. Read More

Cat Berman, CNote’s CEO, was invited to speak at the Women in In Tech symposium at UC Santa Cruz’s Silicon Valley Campus.

The purpose of this event is to: “highlight the experience of women in the tech industry—from established companies to startups and the venture capital firms that support them,” and to “recognize those who have championed the advancement of women in technology through the WITI@UC Athena Awards.” The event also did a great job of assuring that attendees left “with actionable suggestions for overcoming gender-based challenges and improving the workplace climate for all.” Read More

To celebrate #GivingTuesday we will donate $20 to Feeding America for each newly funded account on our platform for the week of 11/28-12/5.

The great folks over at Hint Water were kind enough to host the Challenger Brands conference. A day dedicated to breaking down what it means to be an innovative brand and how that shapes a company, its mission, and its interaction with its customers. Read More

At CNote we believe in financial empowerment. That everyone, regardless of their gender, skin color, or birthplace deserves equal economic opportunity. That is why we make financial products for everyone, not just the 1%. Read More

Table of Contents

Updated July 2021

Community Development Financial Institutions, more commonly referred to as CDFIs, are private sector, primarily nonprofit, financial institutions that provide loans and other financial resources to Low to Moderate Income (LMI) and BIPOC communities that are often underserved by traditional financial institutions.

CDFIs are federally certified entities. That certification comes from the CDFI Fund, an agency within the U.S. Department of Treasury, which explains that “certification is the U.S. Department of Treaury’s recognition of specialized financial institutions serving low income communities.” The fund has certified more than 1,200 CDFIs and these institutions exist in every state and the District of Columbia, serving rural, urban, and native communities while sharing the primary mission of promoting community development.

CDFIs have roots in the civil rights, anti-poverty, and other progressive movements and can trace their origins to local credit unions and banks that sprang up to address predatory or exclusionary lending practices like redlining in communities across America. They believe in economic justice for all people and are federally regulated to focus their lending and business development efforts in low-income and underserved communities.

This article will explain how CDFIs work, their history, and will contextualize their positive impact on society.

If you’d like to dig deeper we’ve also created a more quantitative industry overview, which you can download and read via this link: CNote Whitepaper – Overview of the CDFI Industry (pdf).

Since CDFIs are a fundamental part of CNote’s impact investment offerings, and we make it easy for anyone, from corporate investors to individuals, to invest in CDFIs, understanding CDFIs will provide a more complete picture of the positive impact an investment in CNote has on communities across America.

Tanesha Sims-Summers (far right) is the founder of Naughty But Nice Kettlecorn Co. She received a $50,000 loan from TruFund to complete the build-out of a food truck, which allowed her to attend popular events across Alabama to sell her gourmet kettle corn.

Historically, CDFIs are an asset class that is undervalued despite their catalytic impact in communities. The Brookings Institute had the following to say when looking back at decades of historical data on CDFIs:

“CDFIs have succeeded by all obvious measures. A recent sampling of CDFI performance found that 81 CDFIs managing $1.8 billion in assets had provided more than $2.9 billion in financing. They did this with a 1.8 percent cumulative loss rate, consistently low delinquencies, and no losses of investor principle.”

CDFIs exist to increase wealth building opportunities for LMI populations and ultimately reduce the wealth gap. They provide loans, financial services and educational resources to those left out of the financial mainstream. CDFIs put a priority on enriching their community over enriching their shareholders and focus on supporting economic growth at the community level, usually by financing small, minority-owned businesses, microenterprises, affordable housing, nonprofit and volunteer organizations, and services essential to revitalizing low-income neighborhoods.

Accordingly, a CDFI’s success is measured not only by their growth and financial performance but also by their impact in underserved communities, including increasing access to capital for minority and female entrepreneurs, new job growth and retention, the creation of affordable housing units and availability of affordable consumer loan products.

Typically, CDFIs come in four different forms, banks, credit unions, development loan funds, and venture capital funds. Each of these four institutional models serves a different part of the community and may have different risk profiles, legal structures, and targeted borrowers.

Ebony Harris, center right, received funding from a CNote partner CDFI. Through her learning center, In Good Hands, she has served families in Jackson, TN throughout the pandemic by providing childcare and support so essential workers in her community could continue to work.

CDFIs provide financial services and products to individuals and communities that often do not qualify for services by the standards of mainstream financial institutions. These can be individuals that have nontraditional credit profiles and limited assets, younger borrowers with a shorter financial history or previously unbanked groups. CDFIs frequently recognize that living outside the economic mainstream does not make one uncreditworthy. When assessing people and places that have been shut out from mainstream financial tools like FICO scores and home appreciation, CDFIs consider alternative, though no less predictive, underwriting approaches like savings accumulation rates and history of rent and utilities payments.

It should be noted that despite how CDFI underwriting criteria may diverge from a traditional bank’s underwriting criteria, the Opportunity Finance Network (OFN) and Wells Fargo reported in “Innovations in Underwriting” that “innovative underwriting strategies by CDFIs don’t undermine risk management or portfolio quality. Rather, the new strategies analyze past and current portfolio activity to inform new practices.” Without access to affordable flexible capital, these groups’ ability to generate economic growth remains limited. CDFIs, by making their lending activity more inclusive and supportive of their borrowers, are including underserved groups in the financial mainstream.

The loans that CDFIs make have a tangible impact on their local community. Funds are used to support small businesses, develop affordable housing, build community facilities, and launch or expand other community programs.

As noted by Vice President Kamala Harris on June 15th, 2021 when she addressed the nation to announce federal relief funding for small business via a national network of CDFIs, “Community lenders understand the merit in providing access to capital directly to communities, and because they do they add value to those communities, and by extension our entire nation.”

The Community Development Financial Institutions Fund (CDFI Fund), which will be discussed further below, explained the history and the need for CDFIs in more detail:

Community Development Financial Institutions—or CDFIs—emerged in response to a lack of access to responsible and affordable credit and capital in minority and economically distressed communities. The CDFI “movement” took shape in the 1970s with the passage of the Community Reinvestment Act, which encourages financial institutions to meet the needs of all sectors of the communities they serve. Amid growing concerns about the social consequences of investment decisions made by the financial services industry on the nation’s low-income communities, early CDFIs began filling a niche by providing capital and credit in areas that are often difficult for traditional financial institutions to serve. (source)

One example of a successful CDFI with transformative impact is Black Hills Community Loan Fund, a Native CDFI dedicated to creating financial opportunities for economically disadvantaged families who aim to strengthen their financial future in the Black Hills Region of Rapid City South Dakota. With the Native CDFI designation, 51% of an organization’s clientele has to be Native American. BHCLF’s Executive Director estimates that their clientele is coming in at 90% Native American. In Rapid city 10% of the population overall is Native American, and within that population, more than 50% live below the poverty line. BHCLF’s programmatic offerings are centered around financial education, mentorship for entrepreneurs, first-time homeownership, and youth outreach in addition to its lending. You can read more about their impact here.

Executive Director Onna LeBeau (far right) and her full staff for the Black Hills Community Loan Fund

Looking again at the Brookings Institute’s comprehensive retrospective on CDFIs, Taking Stock: CDFIs Look Ahead After 25 Years of Community Development Finance, Brookings found that “CDFIs have helped prove several things, many of which now constitute mainstream market thinking.” Those included:

Individual CDFIs are certified by The Community Development Financial Institutions Fund (CDFI Fund). The CDFI Fund is an agency within the U.S. Department of the Treasury that was established by the Riegle Community Development and Regulatory Improvement Act of 1994.

The CDFI Fund’s mission “is to expand economic opportunity for underserved people and communities by supporting the growth and capacity of a national network of community development lenders, investors, and financial service providers.” You can read more about the CDFI certification process here. CDFIs, despite being certified by the CDFI Fund, are non-government entities. CNote only invests money with CDFI-Fund certified institutions.

CDFIs, which are certified by the CDFI Fund, then go on to make loans throughout their local communities. The CDFI Fund summarized its model as follows:

“The CDFI Fund supports the mission-driven financial institutions working on a local level that know their communities best. Financial institutions that become certified by the CDFI Fund are eligible to apply for the comprehensive services it offers—including monetary support and training to build organization capacity. The CDFI Fund’s model is competitive and each of its programs provides CDFIs with the flexibility to determine the best use of limited federal resources in their community.”

(source)

The aim of the CDFI Fund “is an inclusive economy: an America where all citizens have the chance to participate in the mainstream economy.” CNote supports this goal by driving investor capital to these CDFIs, allowing them to expand their impact and fulfill their mission of financial empowerment.

CDFIs have a significant impact on the economic growth of the United States. Nationwide, the CDFI industry manages more than $222 billion, creating jobs, affordable housing, financial health, and opportunity for all. While the focus of CDFIs may be on their local communities, these local activities can have a real impact on the broader economy.

In 2016 CDFIs provided over $3.6 billion dollars in financing to underserved communities (source). While the focus of CDFIs may be on their local communities, these local activities can have a real impact on the broader economy. Here are the 2016 results as provided by the CDFI Fund:

In fiscal year 2016 alone, CDFI Program awardees reported that they provided $3.6 billion in financing to homeowners, businesses, and commercial and residential real estate developments. These developments include the construction of community facilities in communities that might not otherwise have these amenities. In addition, CDFI Program awardees financed over 13,300 businesses and provided more than 427,000 individuals with financial literacy or other training. Similarly, in 2016, over $3 billion in loans and investments were made possible under the New Markets Tax Credit Program, with over 74 percent of the loans and investments made in Severely Distressed Communities. This critical financing contributed to more than 10,000 jobs and an estimated 26,000 construction-related jobs; and resulted in more than 600 affordable housing units, 10.1 million square feet of commercial real estate, and 5,500 businesses receiving financial counseling or other services.

(source)

According to the Opportunity Finance Network (OFN), a network of CDFIs, through its fiscal year 2018, its member CDFIs provided more than $75 billion in lending. This led to the creation or maintenance of 1.56 million jobs, the start or expansion of 419,150 businesses and microenterprises, and the development or rehabilitation of over 2.1 million housing units and 11,592 community facility projects.

This data shows just how concrete of an impact community-focused lending can have on the broader economy. These investments in small businesses and community development lead to job growth and economic prosperity. In summary, CDFIs help deliver economic opportunity to everyone

To that point, this video illustrates the kind of opportunity CDFIs provide to borrowers:

In addition to capital, CDFI’s differentiate their success and impact via technical assistance. They provide tailored support and guidance to the entrepreneurs they support. These CDFIs know the common issues small businesses in their communities face, and they can help them overcome obstacles to grow and become sustainable entities that create jobs and increase the tax base.

An example of this local expertise and guidance was the ongoing support that Access to Capital for Entrepreneurs, ACE, was able to provide to budding franchisee Felicia Parks. Felicia, a veteran, decided to open a Jimmy John’s store in Atlanta with her sons but being a first time business owner, she needed some help. Initially, ACE was able to assist Felicia with her business operations via a business coach; however, when COVID-19 hit, Felicia received a bridge loan from ACE to cover operating costs until she could secure a PPP loan through another lender. Unlike many of the business owners around her, Felicia’s Jimmy John’s never had to close its doors. Now, as she’s preparing for life after the pandemic, ACE has provided guidance and advice to help Felicia navigate the next 12 months, and Felicia is making use of ACE’s online resources on marketing, management, and finance, all geared toward getting her business back up and running after COVID.

Felicia Parks (far right) is the owner of a Jimmy Johns location in Atlanta. When COVID-19 hit the area, her sales dropped 64%. She connected with a CNote CDFI partner, who provided a bridge loan that enabled Felicia to keep her head above water and her store open.

CDFIs do much more than cut a check and walk away. They provide guidance, support, and expertise. They share success with their borrowers. By extension, every investor at CNote shares in the success of our partner CDFIs as they work to increase access to capital for communities in need and create more inspiring stories like that of veteran turned entrepreneur, Felicia Parks.

The risk profile of CDFIs has been assessed and the reality is that CDFIs do not present significantly more risk than non-CDFI financial institutions.

CDFIs also have the benefit of certain federal programs like the CDFI Bond Guarantee Program, which provides federal guarantees for bonds issued by CDFIs that make investments for eligible community or economic development purposes. We note that every investors’ appetite for risk can vary. While the research cited below can help guide an investment decision, it is not investment advice; Always consult with a financial adviser to find the investment option that is best for you.

In late 2014, two independent reports on the CDFI program “found that CDFIs have no more risk than conventional lenders and that they perform nearly just as well as mainstream financial institutions.” The first report, CDFIs Stepping Into the Breach: An Impact Evaluation Summary Report, undertaken by Michael Swack, Eric Hangen and Jack Northrup from the Carsey School of Public Policy at the University of New Hampshire made the following key conclusions:

The second report, Introduction to Risk and Efficiency among CDFIs: A Statistical Evaluation using Multiple Methods, conducted by Gregory Fairchild from the Darden School of Business at the University of Virginia and Ruo Jia from the Stanford Graduate School of Business determined:

This research suggests that CDFIs, when managed properly, can deliver returns at or below the risk profile of their non-CDFI counterparts.

CDFIs have consistently operated on the front lines of economic disasters such as 9/11, Hurricane Katrina, Superstorm Sandy, Hurricane Harvey, and the 2008 financial crisis, providing economic relief to American communities when they need it most. The Federal Reserve has recognized CDFIs as “economic shock absorbers” that continue to effectively serve their communities even amidst the most catastrophic economic conditions. Not surprisingly, we’re seeing that now in full force with this pandemic and the associated economic fallout.

The COVID-19 health crisis has had a traumatic and far-reaching impact on American communities, especially low-income communities and communities of color where small businesses play an essential role in sustaining economic growth. CDFIs have been essential to recovery as a crucial lifeline for small businesses across the country during the pandemic, and even for decades before.

During the Great Recession, when mainstream finance retracted lending, CDFIs maintained their lending activities and kept capital flowing to low income communities. With consistently low loan loss rates—a cumulative 0.73% from 1999-2017 that outperformed the 0.92% loan loss rate of FDIC-insured institutions in that same time period— CDFI lending has proven effective and successful in changing economic conditions.

Brighter Beginnings (staff pictured above) is a non-profit which provides vital medical and social services to low-income and minority families in Richmond and Oakland, California. They received a critical PPP loan from CNote partner, Self-Help Federal Credit Union, which allowed them to rehire employees, and continue serving the community.

After the pandemic began, a subset of about 300 CDFIs delivered $7.4 billion in PPP loans within the first three months. For comparison, JPMorgan Chase, which is the largest PPP lender and whose assets total $2 trillion, made only four times as many PPP loans as CDFIs did while being about nine times the size of the CDFI industry. In 2021 when the PPP portal reopened for an additional round of federal relief capital at the beginning of 2021, CDFIs were granted an exclusive access period to fulfill loan applications in recognition of their unique position to reach those being hit the hardest by the health and economic effects of the pandemic.

CDFIs have led the way for decades in supporting recovery efforts and it has been no different during the pandemic, and are essential to the health of our economy as a whole.

In September of 2019, CNote co-hosted a webinar with leading CDFI, Access to Capital for Entrepreneurs (ACE). You can watch the webinar below or register and watch it on demand anytime here.

Large banks and foundations of all sizes have been investing in CDFIs for decades. Until recently, investing in a diverse pool of CDFIs at scale presented significant challenges for all but the savviest of investors. Now, with CNote, investors of all sizes can deploy capital across a diverse pool of CDFIs with ease.

This presentation provides an overview of the CDFI industry, its history, how CDFIs are certified by the Department of Treasury, their mission and the types of investments CDFIs make in the communities they serve. Most importantly, this webinar explores the way increased capital access and CDFI lending activities can have a transformative effect.

“Even if you never apply for a loan from a CDFI, you should care about them. These institutions serve in places that the financial sector historically hasn’t served well. And that lifts our whole economy up.”

Prior to CNote, investing in a CDFI was a difficult, rigorous, and generally limiting process. CDFI investments can often be bespoke undertakings.

Today, anyone can invest as little as $1.00 in CDFIs to earn a higher return on their savings and have an impact on communities across the country. CNote optimizes for impact within its portfolio of CDFIs, and is the first company to make CDFIs, as an asset class, available to all investors.

If you are interested in investing in community development and want a better return on your savings, CNote might be a good option for you.

On September 27, 2017, CNote launched its impact investing product to all investors. You can also check out our launch coverage recap. Below, CNote Co-Founder Yuliya Tarasava details what it took to bring CNote to all investors and her aspirations for the financial sector and CNote going forward. Read More

At CNote, we know trusting someone else with your money is a huge deal, that is why we built multiple layers of protection into every CNote account. These layers of redundancy help minimize the risk of capital loss. While our CDFI partners have never lost a single investor dollar, we want you to feel confident about your investment in CNote. Knowing that your investment has a strong history of consistent performance is one thing, knowing that you’re likely protected even if something goes wrong is even better.

The infographic below helps explain CNote’s Triple Protection Plan. If you want to read further, you should review our Risk & Return page.

This means we’ll be pitching at the Innovate and Celebrate conference in San Francisco. We’re hoping a little home-field advantage works in our favor. This is the first time CNote has presented at this event so it promises to be exciting.

The conference is co-hosted by Consumer Technology Association (CTA) (they run another event you might know, CES) and TechCo Media.

We’re looking forward to sharing CNote’s story with even more people, and seeing what some of the brightest and most innovative entrepreneurs are up to. Along with spreading the word about our mission of financial empowerment, we’d be lying if we said we we’rent just a little fired up for some friendly competition. Also, its hard not to discount all the inspiration you come away with after attending an event like this.

Click the very official badge below to see the other semifinalists and cast your vote for CNote!

We’re also excited to announce that of the 100 semi-finalists, 29 have female founders or co-founders. As you likely know, CNote is helmed by our female co-founders, Cat and Yuliya. CNote, is in good company on this list and we’re excited to see more female entrepreneurs get the recognition they deserve. Hopefully, it will be 50/50 in the near future!

Thanks for your support!

-Team CNote

Previously, CNote was only available to accredited investors. Since our goal is to increase financial inclusion in this country, being limited to the wealthiest investors was never going to cut it for us.

After months of working with the Securities and Exchange Commission (SEC) and our dedicated legal team, we are delighted to announce that we have been qualified by the SEC to offer our product to everyone! You can review our offering circular to learn more about CNote, and the innovative financial product we have brought to market.

For current account holders, nothing will change. We’re grateful you’ve been with us from the beginning, and you’ll still receive the same great return with a positive social impact.

For the list of non-accredited investors waiting to earn 2.5%, we are excited to welcome you with open arms! You should expect an email shortly explaining how you can transfer funds and start earning money. We know some of you have been waiting for quite a while, we are excited to welcome you to the CNote family.

Our full press release is available below (pdf).

September 27, 2017 // Oakland, CA // CNote, which offers up to 40x the return of a typical savings account, is announcing the public launch of its impact-focused financial platform. Previously in a testing a period with accredited investors, who collectively committed more than $9 million in savings, the Oakland-based startup is now open to everyday savers and non-accredited investors with no minimum deposit required. The startup’s flagship product has made history as the first high-yield impact product to be qualified by the Securities Exchange Commission (SEC) for mass market.

Functioning as a high-yield savings product, CNote pools deposits from multiple savers and invests it in highly-impactful, but largely unknown, Community Development Financial Institutions (CDFI). CDFIs are U.S. Treasury certified, and exist to help finance and support underserved populations like women and minority business owners.

CNote provides a 2.5% return to savers, a stark contrast to the 0.1% – or less – that most savers receive from traditional banks.

Founders Catherine Berman and Yuliya Tarasava built CNote out of a desire to help savers do good and do well. The result of their collaboration is the first savings product to deliver outsized returns and positive social impact.

In December, the team ran a successful test with accredited investors, with over $9 million in committed savings under Reg D. In March, the company was selected as Best Startup Pitch Company at SXSW, as well as the Fintech Category Winner.

As the first platform of its kind, CNote is launching to the general public today with a cohort of CDFI partners, including CDC Small Business and Pursuit Lending. They each provide a range of services and financing options for business owners who are often ignored or underserved by traditional financial institutions.

“There’s an estimated $300B of cash that just sits on the sidelines collecting dust in our savings accounts. There’s no reason we can’t unlock it for good by putting that money to work in our communities, while driving better returns for you,” Catherine Berman, CEO and Co-Founder of CNote said. “We could not be more thrilled to open our platform to everyday consumers and smart savers, and we hope people will see this as an opportunity to think outside the bank.”

This product is the first of CNote’s suite of competitive-yield, high-impact products that seek to redesign finance with a focus on financial inclusion and empowerment.

Interested CNote users can learn more about the platform at www.mycnote.com.

###

About CNote

Founded in 2016 by Catherine Berman and Yuliya Tarasava, CNote is a financial platform for socially-conscious savers and investors. The company’s flagship product offers a 2.5% return on savings — and 100% social impact — by tapping into Community Development Financial Institutions (CDFIs), which exist to help finance underserved small business owners. In September 2017, CNote became the first competitive-yield financial product to be federally recognized and available to the mass market with no minimum and no fees.

In March 2017, CNote was selected as Fintech Category Winner at South by Southwest. The venture-backed fintech company currently operates with a team of 8 out of Oakland, California.

Note that effective January 1, 2019, the rate on all CNote accounts has increased to 2.75%.

For immediate release (pdf).

September 27, 2017 // Oakland, CA // CNote, which offers up to 40x the return of a typical savings account, is announcing the public launch of its impact-focused financial platform. Previously in a testing a period with accredited investors, who collectively committed more than $9 million in savings, the Oakland-based startup is now open to everyday savers and non-accredited investors with no minimum deposit required. The startup’s flagship product has made history as the first high-yield impact product to be qualified by the Securities Exchange Commission (SEC) for mass market.

Functioning as a high-yield savings product, CNote pools deposits from multiple savers and invests it in highly-impactful, but largely unknown, Community Development Financial Institutions (CDFI). CDFIs are U.S. Treasury certified, and exist to help finance and support underserved populations like women and minority business owners.

CNote provides a 2.5% return to savers, a stark contrast to the 0.1% – or less – that most savers receive from traditional banks.

Founders Catherine Berman and Yuliya Tarasava built CNote out of a desire to help savers do good and do well. The result of their collaboration is the first savings product to deliver outsized returns and positive social impact.

In December, the team ran a successful test with accredited investors, with over $9 million in committed savings under Reg D. In March, the company was selected as Best Startup Pitch Company at SXSW, as well as the Fintech Category Winner.

As the first platform of its kind, CNote is launching to the general public today with a cohort of CDFI partners, including CDC Small Business and Pursuit Lending. They each provide a range of services and financing options for business owners who are often ignored or underserved by traditional financial institutions.

“There’s an estimated $300B of cash that just sits on the sidelines collecting dust in our savings accounts. There’s no reason we can’t unlock it for good by putting that money to work in our communities, while driving better returns for you,” Catherine Berman, CEO and Co-Founder of CNote said. “We could not be more thrilled to open our platform to everyday consumers and smart savers, and we hope people will see this as an opportunity to think outside the bank.”

This product is the first of CNote’s suite of competitive-yield, high-impact products that seek to redesign finance with a focus on financial inclusion and empowerment.

Interested CNote users can learn more about the platform at www.mycnote.com.

###

About CNote

Founded in 2016 by Catherine Berman and Yuliya Tarasava, CNote is a financial platform for socially-conscious savers and investors. The company’s flagship product offers a 2.5% return on savings — and 100% social impact — by tapping into Community Development Financial Institutions (CDFIs), which exist to help finance underserved small business owners. In September 2017, CNote became the first competitive-yield financial product to be federally recognized and available to the mass market with no minimum and no fees.

In March 2017, CNote was selected as Fintech Category Winner at South by Southwest. The venture-backed fintech company currently operates with a team of 8 out of Oakland, California.

Note that effective January 1, 2019, the rate on all CNote accounts has increased to 2.75%.

If you are new to CNote you may have some questions. How do you pay 2.5%? How safe is CNote? Where does my money go?

The video below should help answer most of these questions in only 60 seconds.

Transcript of the video:

So you may be wondering, how does CNote earn you 2.5% on your savings when your bank pays you next to nothing?

Unlike banks, CNote doesn’t use your savings to fund credit cards or mortgages. We lend your deposits out to US-Treasury-certified community lenders that have more than 20 years of proven financial performance.

These community lenders build our schools, fund our community centers and invest in the women and minority-led businesses that keep our communities thriving.

Until now, access to these high performing community lenders was only readily available to large banks and foundations. CNote’s proprietary technology gives every-day investors like you access to these investments.

Also, unlike banks, we return the profit earned on these loans back to you instead of keeping it to pay big bonuses and excessive overhead. We never charge you any fees, and the 2.5% goes straight into your pocket.

Welcome to a world of finance driven by good, not greed.

Welcome to CNote.

Note that effective January 1, 2019, the rate on all CNote accounts has increased to 2.75%.

This video explains how CNote is able to deliver a higher return on your savings while driving prosperity in communities across the United States. It highlights the institutions we invest in, their proven financial track record, and the tangible impact that they have.

Finance shouldn’t be complex or hard to understand. This video should help answer some of the questions you may have about CNote.

Odds are that you have heard of the guy pictured below. He’s fundamentally changed the way we look at the physical world. Yet, despite his amazing contribution to science, he had some pretty significant thoughts about other important areas of life as well. Read More

Indeed, its been about six months since CNote won the Fintech Category and took home Best Startup Pitch Company at SXSW. A lot has changed, our team has grown, but the most important things have stayed the same.

Despite growing as a company since March, our focus and core goals of offering a better return with tangible social impact have not changed.

In the future, the fashion might change, and the video cameras might get better, but we believe this pitch, delivered by co-founder Cat Berman, will reflect our core principles for years to come. That is why we decided to share it again as a reminder to our community, employees, and customers about the goal we are working towards. We are working to make finance more inclusive; where great returns are not reserved for the wealthy few. We are also crazy enough to think that you can get a great return while bringing prosperity to financially underserved communities and individuals across the country.

Hi, my name is Cat Berman, co-founder of CNote. Before I started CNote I was Managing Director at Charles Schwab and there I stumbled on this shocking finding, American’s are sitting on 300 billion dollars in just in case cash, not emergency fund cash but literally just in case cash. These are dollars sitting in our checking and savings accounts making nearly zero percent. What’s worse, we’re actually losing money, you see savings accounts don’t keep up with the rate of inflation anymore so you and I are losing about one percent of our nest egg, simply by leaving it in the bank, until now.

CNote delivers a return on your savings, two and a half percent, that’s 40 times better than traditional banks with 100% impact. We do it by working with a little known, but highly successful, financial tool called CDFIs. CDFIs aren’t new, they’ve been around for 20 years, they’re certified by the treasury department and nearly every major US bank uses CDFIs. What’s more, is every dollar invested in CDFIs goes to under-severed communities like women and minorities. CNote is the first and only company to unlock CDFI return and impact for every day savers.

How’d we do it, by creating a proprietary technology to optimize our savings across CDFIs. The team includes my co-founder Yuliya Tarasava, she ran a 10 billion dollar risk management function, Nikhil Desai our VP of Engineering was Senior Developer at Lending Club and this will be my 3rd start up. My last start up, Global Brigades is now in 5 countries. Last summer we launched our beta and to date we have over 7 million in savings on our platform. We’re excited for this year where we’ll be rolling out to potential 8 million customers with our 1st channel of distribution partner and donor advised fund. The average CNote saver starts by making 10 dollars a year on their savings account and with CNote ends up making over 500 dollars a year, just by signing up in 3 minutes.

You work hard for your savings, it’s time your savings will work hard for you.

Earn more with good karma. Welcome to CNote.

Click below to watch.

We’ve got a lot of new and exciting things on the horizon. We look forward to sharing more of our story with you here.

Join us, as we work to make finance more inclusive.

-Team CNote

While New York City is overflowing with artists and creatives, one thing the city is always short on is space. This is especially true for musicians who need rehearsal spaces that are both affordable and acoustically sound. That’s where Roberto Romeo (pictured) saw a tremendous opportunity to expand his small business and support the community of local musicians. Read More

La Newyorkina is a place for handmade Mexican ice cream, paletas (ice pops), chamoyadas & other treats. It is also a fan favorite all around New York City. La Newyorkina is known for using unique flavors, fruits, and ingredients in its colorful paletas (Mexican popsicles). The journey to small business success wasn’t always sweet, but this story highlights just how integral a role community lenders can play in helping small businesses succeed, and the positive impact these loans can have on the communities they serve.

Read More

We lived in a world where we could vote with our dollars – in everything we do.

Not just by buying a cup of coffee from the local shop we love, but by actually investing in that shop’s growth and success.

And what if we benefited too? Not only by feeling great about supporting our community, but actually creating financial freedom for ourselves along the way.

This is what we are creating..and we hope you’ll join us for the journey.

We are CNote.

CNote stands for co-creation. The idea that every $100…and really every $1…can be intentional and meaningful.

Instead of investing in what we’re told to invest in — stocks, bonds, ETFs, whatever the next acronym is — we invest in each other.

We call it investing in people, not products.

The feedback we’ve gotten so far has been inspiring and quite moving.

Join us creating a meaningful alternative for where our money goes and what our money stands for.

Join the village!

– Cat Berman, Co-founder