CNote commissioned a survey to understand how people plan to use their tax returns this year. We also asked those same people whether they thought the recent tax law changes would benefit them.

Some of the survey results were consistent with expectations, and others were surprising.

Table of Contents

First, why commission a survey at all?

CNote is a company dedicated to building financial products that provide more value to consumers while building a more inclusive economy. Taxes have a significant impact on individual wealth, and can significantly impact the distribution of wealth across a country. We’d be remiss if we weren’t thinking about how broad policy decisions impact our goals of increasing economic inclusion.

Arguably, the structure of the tax code is one of the most important economic decisions a government makes. Tax policy can impact economic production, favor certain industries, redistribute wealth, and steer the direction of a country’s economy. Tax policy is filled with tradeoffs: Is your tax policy progressive or regressive…who is taxed more, the rich or the poor? Are you fueling a deficit or surplus? Does your tax code encourage consumption or saving?

These are all important questions for policymakers to consider.

CNote’s mission is to help people be better savers and give the financially underserved full access to the modern economy. To that end, we believe we should be looking at policy choices and broad trends to inform our product development and to reflect on how we can best meet our customers’ needs. To illustrate, if we see more structural inequality as a result of the tax code or changes in government programs, perhaps we should focus on building products that will help address these structural changes in the economy.

How are you spending your tax return this year?

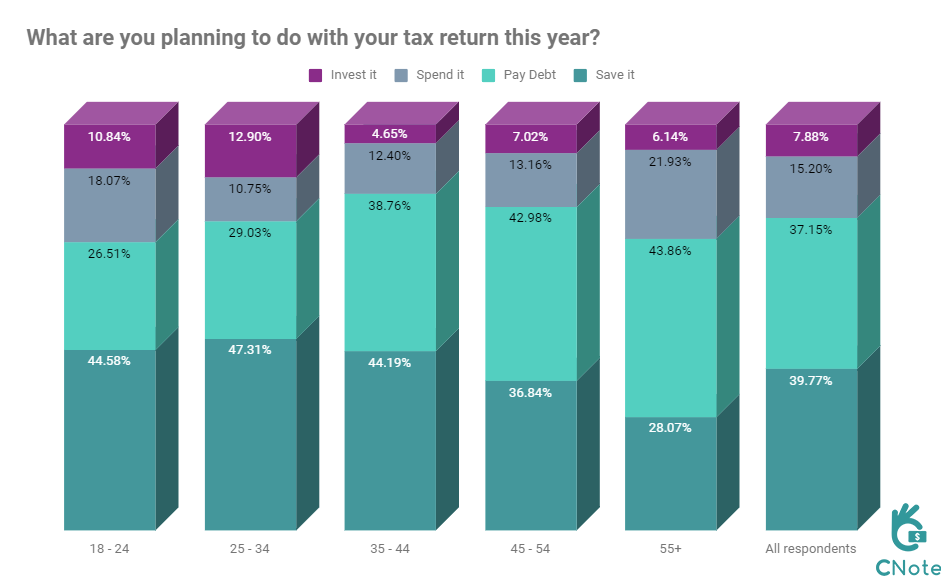

That chart below breaks down how individuals who are receiving a tax return in 2018 planned to use it. Segmenting by age highlights some interesting trends. Looking at all age groups, people were most likely to save their return, followed closely by paying down debt, with spending and investing as distant third and fourth options. Now, on to some takeaways.

Young cohorts are more likely investors than their older counterparts

With all the recent headlines about a lack of savings and runaway consumption (read: avocado toast) by younger age groups, it was interesting to see that those aged 25-34 and 18-24 were the most likely to invest their returns. Surprisingly, the group that was the least likely to invest, those aged 35-44, might be the group that should be investing the most, given the benefits of compound returns and investing early for retirement. Perhaps those avocado-toast-eating millennials have some financial advice to share after all.

Not surprisingly, the oldest age groups showed a decreased tendency to save as they approached retirement age and started to turn into net spenders rather than net savers/investors.

Those aged 45 and older have more debt to deal with

The two oldest segments, 45-54 and 55+, were most focused on paying down debt with their tax returns. This is consistent with headlines that suggest many American’s have significant debt loads to pay down.

Indeed, the Federal Reserve recently confirmed that American households’ outstanding debt climbed to an all-time high of $13.1 trillion. The fact that older generations have more debt makes sense when you consider that a mortgage typically accounts for the majority of a households’ debt burden (in the previous link, mortgages account for 68% of all household debt).

Saving is a priority across many age groups.

For individuals aged 18-44, the savings rate hovered between 44 and 47 percent. Even for those aged 45-54, around 36% of respondents still planned to save their return. Not surprisingly, those aged 55+ had the lowest number of planned return savers at 28%.

Those demographic trends aren’t particularly surprising–savings rate decreases with age as you spend more than you make.

What is surprising is just how committed to saving those aged 44 and under were. With around 44% of respondents committing their return to savings, it suggests a strong drive to build a buffer for any financial hardships. For many individuals, their tax return may be the biggest check they get all year, committing it to savings is a strong statement about younger age cohorts’ commitment to sustained financial health.

Will the new tax law benefit you?

Economic expectations can have a big impact on future economic behavior.

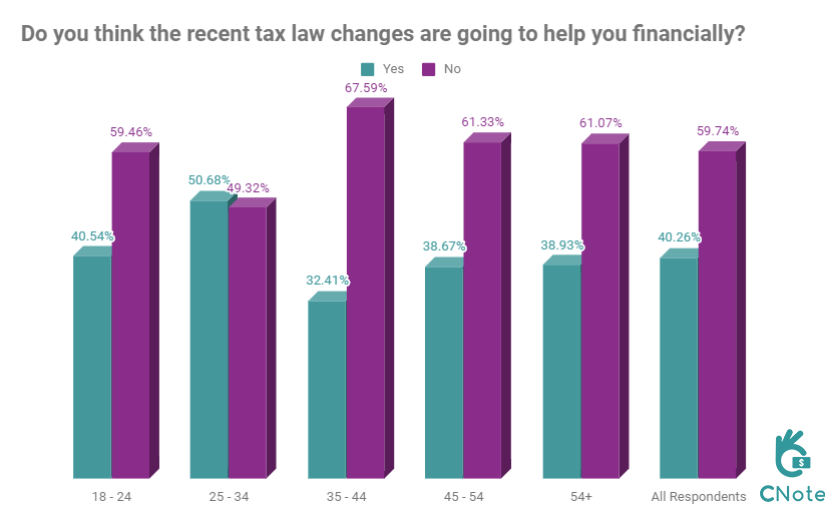

We asked whether people thought the new tax laws were going to benefit them in order to get a glimpse into their future economic expectations. Nearly all age groups agreed that the new tax laws were unlikely to benefit them. Whether this will have any lasting impact on consumption remains to be seen.

Surprisingly, of all the age groups, those aged 25-34 were most likely to express some hope that the bill might help them financially with a close to 50/50 split. Strangely, those most confident that the new tax law would not help them were those aged 35-44. It’s hard to reconcile such a divergence from the 25-34 age group.

Nonetheless, it is interesting to see such consistently negative opinions associated with such an important piece of economic policy. This could have an impact on elections, and tax policy going forward if these negative expectations converge with reality and lead to higher taxes for the majority of Americans.

Wrapping Up

So what are the big takeaways? Americans are more committed to saving (or they are committed to saying they are in surveys) than you would expect based on the headlines.

Younger groups are focused on investing in their future, and nearly everyone thinks the new tax laws won’t do much for them.

We’ve got some hypotheses based on this survey, but we’ll have to see how it all shakes out. We’ll continue to encourage consumers to save and join us as we work to build a more inclusive economy.

CNote commissioned this survey of 700 respondents from the third-party research service PollFish in February of 2018.